Personal loans can be a helpful financial tool, whether you’re consolidating debt, covering unexpected expenses, or funding a major purchase. However, if you’re not careful, you might pay high interest rates and hefty processing fees that can cost you more in the long run. The good news is that with some strategy and research, you can secure a personal loan with favorable terms, including a low interest rate and minimal fees.

Here are five practical tips to help you land a loan that won’t break the bank.

1. Compare Multiple Lenders Before Applying

One of the biggest mistakes people make when applying for a personal loan is going with the first lender they come across. Whether it’s your bank, a credit union, or an online lender, each has terms, rates, and fees. This is why shopping around and comparing different lenders is crucial before deciding.

Start by comparing the annual percentage rate (APR), which includes the interest rate and any additional fees the lender might charge. A lower APR means lower overall costs. Use online comparison tools to view offers from multiple lenders at once. Many online platforms will allow you to pre-qualify, giving you an idea of what interest rates and terms you’re eligible for without impacting your credit score.

Don’t forget to check the fine print on processing fees as well. Some lenders waive processing fees for customers with excellent credit, while others charge a flat fee or a percentage of the loan amount.

2. Improve Your Credit Score Before Applying

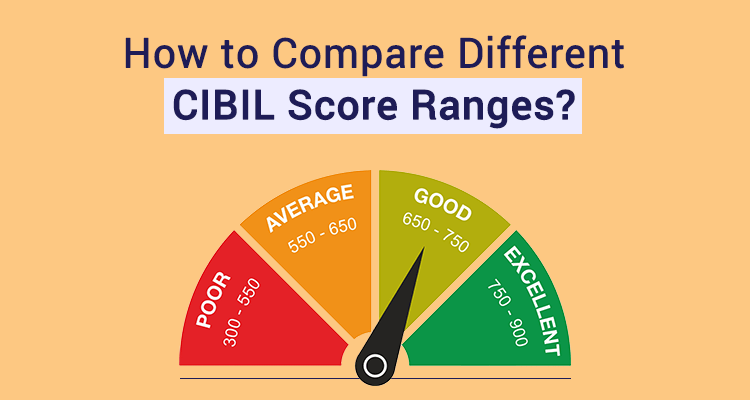

Your credit score plays a massive role in determining the interest rate and the processing fee you’re offered. Lenders use your credit score to assess your risk as a borrower, and the higher your score, the more likely you are to get favorable terms. A low credit score, on the other hand, signals to lenders that you’re a riskier bet, and they may charge higher interest rates and fees to compensate for that risk.

If your credit score is less than stellar, it’s worth taking a few months to improve it before applying for a loan. Here are some quick ways to boost your credit score:

- Pay off outstanding credit card balances

- Ensure you’re making all your payments on time

- Avoid applying for new credit accounts too frequently

- Check your credit report for any errors and dispute them

Improving your credit score’ll increase your chances of qualifying for a loan with a lower interest rate and fewer fees. Many lenders reserve their best offers for borrowers with excellent credit.

3. Opt for a Shorter Loan Term

While longer loan terms might seem appealing because they lower your monthly payments, they often come with higher interest rates. When you opt for a shorter loan term, lenders typically reward you with lower interest rates because you’re paying off the loan faster, reducing their risk. Additionally, a shorter loan term means you’ll pay less in interest over the life of the loan.

Of course, shorter terms result in higher monthly payments, so make sure the payment fits comfortably within your budget. However, if you can manage the larger payments, you’ll save much money on interest in the long run.

It’s also important to check if the lender charges any prepayment penalties. Some lenders may try to recoup their losses by charging you a fee for paying off your loan early, so read the terms carefully before signing.

4. Leverage Your Existing Relationships

If you have a long-standing relationship with a bank or credit union, you might be able to secure better loan terms through them. Financial institutions often provide better deals for their loyal customers. For instance, many banks offer reduced interest rates or waive processing fees for customers with checking or savings accounts.

Additionally, some lenders offer relationship discounts if you set up automatic payments from your bank account. These small savings can add up, especially if you take out a significant loan.

When approaching your bank, don’t hesitate to negotiate. Sometimes, lenders are willing to adjust their terms, especially if they know you’re a reliable customer who may take your business elsewhere. Highlight your loyalty, positive banking history, and other factors that could help you land a better deal.

5. Choose a Secured Loan Instead of an Unsecured Loan

Personal loans generally fall into two categories: secured and unsecured. Secured loans are backed by collateral—something of value you own, like a car or savings account—that the lender can take if you fail to repay the loan. On the other hand, unsecured loans are not backed by collateral and, therefore, come with higher interest rates since they’re riskier for the lender.

If you’re in a position to offer collateral, opting for a secured loan can help you get a lower interest rate and potentially reduce processing fees. However, be cautious when using collateral because if you default on the loan, the lender has the right to seize the asset.

Make sure to weigh the pros and cons of a secured loan carefully. It can be a great way to save on interest, but only if you’re confident in making payments consistently and on time.

Final Thoughts

Getting a personal loan with a low interest rate and minimal fees is all about being prepared and researching. You can significantly lower your borrowing costs by comparing lenders, improving your credit score, opting for shorter loan terms, leveraging existing relationships, and considering secured loan options.

Remember, even a small difference in interest rates or fees can save you hundreds—or even thousands—of dollars over the life of your loan. Take time to weigh all your options and choose a loan that fits your financial needs and goals. With the right approach, you can secure the funds you need without overpaying in interest or fees.